Price discussions can be a little uncomfortable. It’s much more comfortable to talk about features, benefits, cool technology, and awesome demonstration results. Price is such a touchy subject that many capital equipment product managers avoid it in their marketing content. As a result, the unarmed sales team often delays bringing up pricing as long as possible.

However, if your sales team delays the price discussion, they risk

- The customer budgeting too little for your equipment,

- Losing because your price is too high, and

- Not achieving a value-based price for your equipment.

To avoid the problems that can come from waiting too long to bring up price, develop selling tools that put your equipment’s price in the context of its value proposition. Then use those tools to initiate the price discussion early in the sales process.

Bring Up Price in the Context of Your Value

Underling, “My customers always ask me about price early in the sales cycle. What should I do?”

Seasoned sales guy, “Avoid bringing up price for as long as possible. Make sure that the customer understands all of our advantages first. Keep the conversation focused on value.”

What do you think? Good advice, or is this a value-selling mistake?

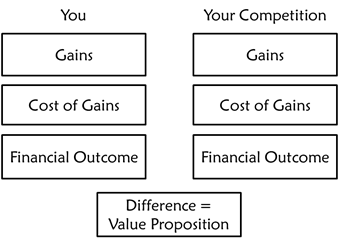

As you might have suspected, there is a fundamental flaw in the seasoned sales guy’s advice. If you don’t talk about price, it’s impossible to talk about value. Promoting all the valuable attributes of your product without the context of price isn’t value selling. Value is the difference between the gains the customer receives as a result of purchasing your product and the cost to acquire those gains.

Your price is part of the customer’s cost to acquire your product’s gains. So the conversation recommended by the seasoned sales guy isn’t a conversation about value at all. It’s a conversation about gains. It’s not a conversation about value until you relate those gains to price. Enter the Why-Buy Presentation. It’s the perfect tool to introduce how your product at your price delivers on your value proposition. It

- Connects the customer’s problem to your solution,

- It substantiates your competitive advantage on the most critical value drivers, and

- It places your price in the context of the financial value you bring to the customers.

The price-to-value connection comes together in the Why-Buy presentation’s comparative financials. These comparative financials reveal how your product delivers on your value proposition at your price. See the example below.

| Units | Mr. Melty | Competitor | |

|---|---|---|---|

| Charge size | kg | 650 | 700 |

| Process time | hrs | 65 | 75 |

| Max throughput | kg/hr | 10 | 9 |

| Mass ingot yield | % | 75% | 65% |

| Yielded throughput | kg/hr | 7.5 | 6.1 |

| Yielded throughput | kg/yr | 65,700 | 53,144 |

| Target annual capacity | kg/yr | 1,500,000 | 1,500,000 |

| Systems needed | # | 23 | 29 |

| System price | $US | 655,000 | 600,000 |

| Total capital expense | $US | 15,065,000 | 17,400,000 |

| Difference | 15% |

In this example, the comparative financials show Mr. Melty’s price of $655,000 in the context of its 15% capital expense savings value proposition.

Bring Up Price Early in the Sales Process

Tension exists in every transaction. Parties to any transaction seek to capture as much value as possible. It’s a contest, and contests create tension. You cannot avoid it. You can, however, choose how to manage it. Your two options are as follows:

- Option 1: Try to establish value-based pricing during the final negotiations. Avoid all commercial conversations until the salesperson has their face-off with purchasing.

- Option 2: Connect value proposition, competitive advantages, and pricing in a value-based framework early in the sales process. Have sales enter final negotiations with value firmly established.

Option 1 is unlikely to produce value-based pricing for the equipment supplier. You have not exposed most of the participants in the buying process to the connection between price and value. Purchasing doesn’t care. Diving-catch attempts to support price with value claims will appear insincere, and the clock will likely run out on your attempts to substantiate them.

Option 2, on the other hand, sets the table for a value-based price discussion with purchasing. The salesperson can frame the argument just as he has framed it since the sales cycle began. When the purchasing manager presents your price arguments to the rest of their buying team, they are not surprised. Throughout the sales process, you have reinforced the connection between your value and equipment price. Therefore, they can rationalize and support your pricing proposal. Option 2 is a much better place to be. The only cost to you is unavoidable price tension shifting to earlier parts of the sales process.

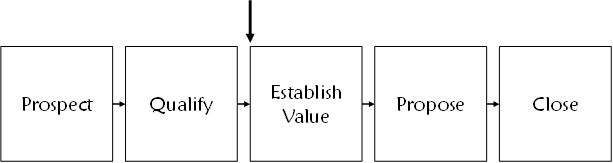

Consider the five-phase capital equipment selling cycle shown below.

In terms of this sales cycle, when would you bring up your price? If your first thought is “Propose,” you have plenty of company. After all, that’s when you first commit all your commercial terms to paper. Plus, it allows you to spend the bulk of the sales process talking about your equipment without the awkwardness of a price discussion.

Not so fast. By bringing up the price for the first time in your proposal, you’ve done nothing to connect it to the value your product brings to the table. Without a tangible connection between your price and value, you won’t have a value-based negotiating position when it comes time to close the order. Therefore, you must bring your price up early in the sales process. See the figure below.