In their book Freakonomics, Steven Levitt and Stephen Dubner argue that your real estate agent doesn’t have your best interest at heart. The culprit? The realtor’s incentive structure.

Your realtor typically gets paid a flat commission based on the sales price of your house. For example, let’s say your realtor has found a buyer. That buyer says he’s willing to pay $500,000 for your house. At 5% commission, your realtor is looking at $25,000.

But you have a $450,000 mortgage to pay off and need a total of $40,000 in net proceeds to put down on the next one. At $500,000 you’re your math looks like this:

| Sales Price | $500,000 | ||

| Sales Commission | -$25,000 | ||

| Mortgage Payoff | -$450,000 | ||

| Net Proceeds | $25,000 |

Quick math says you’ll need to sell for just over $515,000 to hit your $40,000 bogey. That extra $15,000 in sales price will produce 60% higher net proceeds. You’re highly motivated to hold out.

The impact of holding out for that extra $15,000 for your realtor is not significant. He’s only looking at an additional $750 in his pocket. The realtor is motivated to take the deal and not risk his $25,000 commission by recommending that you hold out for a higher price.

You are not aligned.

Freakonomics Comes to Capital Equipment

Many capital equipment companies’ commission plans are not any better at aligning the salesperson and company’s interests than the typical agreement between the realtor and home-seller.

The dynamic is similar. The capital equipment salesperson typically advocates “take the deal” while the business unit owner fixates on finding ways to increase the price. To understand why let’s look at a hypothetical equipment sales situation where:

| Customer Purchase Offer | $1,000,000 | ||

| Product Cost | $600,000 | ||

| Sales Commission Rate | 0.5% |

The company will make $400,000 in gross margin at the customer’s offer, and the salesperson will earn a $5,000 commission.

Boosting the sales price by just 10% would take the gross margin up 25% from $400,000 to $500,000. But Sales is telling you that pushing for a higher price could risk losing the order and is recommending against it.

Are you surprised? You shouldn’t be. The salesperson risks a $5,000 commission for a paltry $500 reward.

Interests Align when Incentives Align

In our earlier example, imagine how your realtor would behave if you agreed to pay a 25% commission on every dollar above $500,000 in final sales price. The sales price would need to be about $520,000 to meet the seller’s need for $40,000 in net proceeds. Achieving that sales price would net the realtor an extra $6,250. For the realtor, that might be something worth fighting for.

The same concept can work in the capital equipment world. Returning to our example, let’s say that we set the commission rate for every dollar in final sales price above $1,000,000 to 5%. Achieving the business owner’s $1,100,000 target price would increase the salesperson’s commission by $5,000 and order gross margin by nearly $95,000. Now both the salesperson and business owner have a lot to gain by finding a path to that higher price.

An Approach for Aligning Sales Incentives

You can align the interest of the salesperson and the owner by accelerating the salesperson’s commission rate for orders above your product’s “natural” price point. In our real estate example, the natural price point might be the average of a few property appraisals or the result of market value analysis. In the capital equipment world, that natural price point might be the customer’s price the last time they purchased from you. The customer “naturally” expects to pay that price or something lower. You should compensate your salespeople for achievement above that expectation.

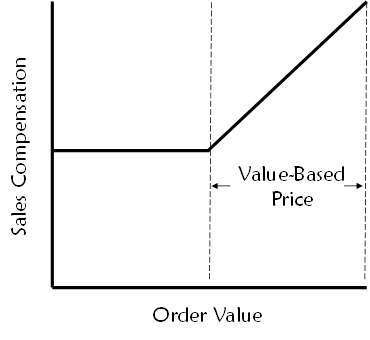

Value-Based Sales-Compensation Model

A value-based sales-compensation model rewards the salesperson based on the customer value captured for the seller. See the figure below.

Sales compensation must accelerate sufficiently to incentivize the salesperson to pursue more value capture. The reward must be commensurate with the risk of losing the order that holding out for higher prices creates. If it’s not, expect the salesperson’s behavior to default to “just get the order.”

Promising gobs of cash isn’t your only solution to get the sales team aligned. If you find yourself resorting to wild compensation schemes, you need to look at the risk side of the equation. The risk of losing an order in pursuit of value-based pricing is a function of your value-based strategy implementation quality. The salesperson’s risk of losing the order in the quest for value-based pricing is low if you have done the following:

- Correctly defined value in the eyes of the customer and relative to alternatives in the market

- Created products that produce more customer value than the competition and priced them to capture fair compensation for that value

- Developed and deployed a robust ability to substantiate value during the sales cycle

If the risk is low, the additional compensation required to get the sales team to pursue value-based pricing will be low as well.