You can already feel the knot developing in your stomach as you begin to imagine how uncomfortable this could get. You’re thinking, “There’s no way you’re going to get away with a why-buy presentation without some customer pushback. It would be much easier if price, claims of customer profitability, and direct references to the competition were left out. With this value-based marketing approach, things could get tense.”

When presenting a why-buy presentation you should expect some customer pushback on how you have framed your value proposition. Some of the most common are

- “Those financials are too simple,”

- “We’ll never pay those prices,”

- “Your competitor data is wrong,” and

- “Don’t refer to your competitors.”

The best way to deal with price tension in a sales cycle is to embrace it. Price tension creates an opportunity to clarify how your customer defines value and calibrate your competitive position.

“Those Financials Are Too Simple”

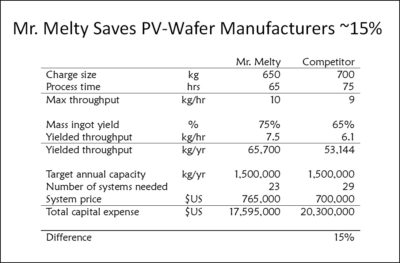

Comparative financials used in a Why-Buy presentation (like those shown below) factor in only the parameters included in your value metric. You do this to keep the conversation focused on only those factors that will affect the buying decision.

A customer may react to that and say, “This is oversimplified and doesn’t account for all the costs associated with owning this piece of equipment.”

To that, you would respond with, “Those other costs are essentially the same across all suppliers. We’ll help you get those numbers if you need them for your cost-of-ownership models. Our intent here was to highlight those factors that we thought would be most helpful to you when choosing among equipment suppliers.”

You might even use the customer reaction as an opening for a little more discovery. You might ask, “Have we missed any additional factors that will be significant to your buying decision?”

“We’ll Never Pay Those Prices”

Don’t be thrown by pushback on pricing. You don’t actually expect them to pay the prices shown in an early why-buy presentation, either. You want them to connect with the idea that they will get more value from you, even if they pay you a higher price than the competition.

Just respond with something like, “A lot of things will affect final pricing. I just wanted to illustrate the added profitability you can expect with our system when compared with alternatives in the market.”

“You’re Competitor Data Is Wrong”

In a why-buy discussion, you’ll make your understanding of the competition’s capability very clear. In doing so, of course, you expose yourself to the potential of being wrong.

But avoiding this part of the conversation precludes you from ever achieving value-based pricing. Value is relative to alternatives in the market. You cannot establish value-based pricing without reference to the competition. This is no time to wimp out. It is better to be wrong and know it than to be wrong and not know it.

So, if the customer corrects one of your assumptions about the competition, embrace the new data point. If validation shows that the customer was straight with you, your competitive intelligence just improved – and so did your chances of achieving value-based pricing.

“Don’t Refer to Your Competitor”

In the capital equipment world, what’s acceptable when talking about your competition can vary widely. Some equipment buyers strongly object to a supplier making direct references to a competitor, whereas others welcome or even encourage it.

There is a solution. The following are three ways to talk about your competitors. Just select the one that is most appropriate for the customer environment in which you are operating.

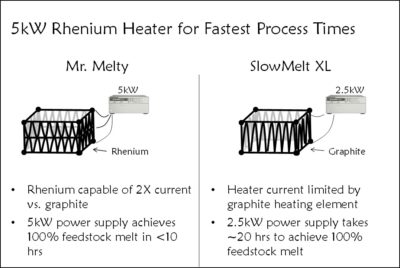

Name Them

If you are operating in an environment where naming competitors is acceptable or even encouraged, do so. It can be your most effective option. It won’t leave any doubt in the customer’s mind about whom you are talking about and what your differences are. In this case, you might produce a slide like the one below to substantiate the source of your “fastest process time” advantage.

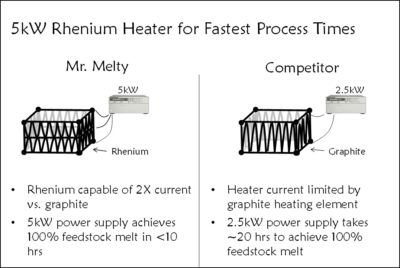

Don’t Name Them

In some environments, it’s acceptable to refer to competitors, just not by name. You need to make only a small adjustment to the “name them” approach: substitute the competitor’s actual name with the generic equivalent. See below.

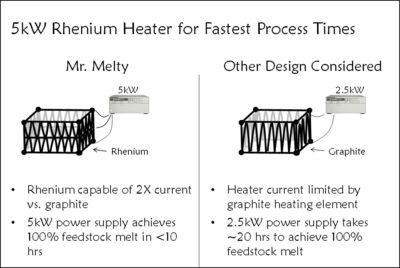

Use “Design Considerations”

In certain environments, your customers may insist that you talk only about your company and your products. This can be the most challenging for the marketer who knows that he must differentiate or die. Have no fear; there’s a solution for this scenario as well. Let’s call it the “design considerations” approach.

Here, instead of referring to the competition in any way, you’d refer to different product-design approaches that you considered. Of course, one of those designs is superior and is the one your company chose, and the other is inferior and just happens to be the one the competition pursued. See below.

Your voice-over for the slide above would start with something like, “We looked at both rhenium and graphite as potential heater-element materials. Rhenium turns out to have twice the current carrying capacity. That meant we could attach a much larger power supply. The result was process times that are about half that of a graphite-based system.”

It’s this head-to-head comparison that cements your differentiation in the customer’s mind. It makes it clear why the customer should choose your product over the alternative. Now, with these three methods, you can highlight your advantages in virtually any customer environment.