Table of Contents

- Introduction

- Who Does What

- Where to Find the Raw Data

- Establish a Closed-Loop System

- How to Plug the Tough Holes

- Why Sales Fails to Get You Competitor Data

Introduction

Competitive intelligence gathering is like a scavenger hunt. However, you cannot conduct this hunt as random bursts of effort if you want to develop and maintain effective competitive intelligence. You need a process.

Who Does What

Leadership for ensuring robust competitive intelligence falls squarely on product managers. They ensure that a system is in place where everybody understands their role, and that the company uses its intelligence to inform product and marketing strategy.

Competitive data collection must be a formal part of the job description for organizations with regular contact with the market. Besides product management, this includes sales, service, application, and management.

The analysis process that turns raw competitor data into true competitive intelligence belongs to the product management function. It is the product manager’s job to reconcile conflicting data and figure out what the data means to the business and how to respond.

Finally, for competitive intelligence to be useful, it must get into the hands of the people in your organization who need it. Product management must package all the collected intelligence and analysis into a useful form and then distribute it. See Table 15.

| Activity | Responsibility |

| Lead | Product management |

| Collect | All organizations that have regular contact with the market |

| Analyze | Product management |

| Distribute | Product management |

Where to Find the Raw Data

Places where you can information about your competitors include:

- Public presentations by competitors that provide information about their strategies and plans

- Annual reports and regulatory filings

- Articles, news stories, and other features created by someone inside or outside the company

- Product specification sheets and other company literature distributed at conferences, trade shows, and other events

- Physical observation of competitor activities at your customer sites, trade shows, or investor events

- Special studies, research papers, and analyst reports about an industry or company

- Interactions with customers, suppliers, and other industry participants

- Industry-specific social network sites

- Patent filings

Bits of competitor data are all around. But you must look for it. It is like walking through the woods where wildlife is all around you. If you are not paying attention, you will never know it is there.

Establish a Closed-Loop System

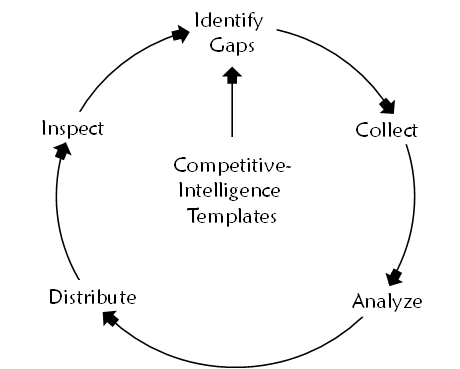

Developing competitive intelligence is a perpetual process. The data is always changing, incomplete, or requiring further validation. You need a closed-loop management and control mechanism that ensures a rigorous, dependable process. See Figure 38.

To get your process started, create fill-in-the-blank templates that identify all the data that you need collected and analyzed. Try structuring these in presentation format. That way, when it is time to distribute and communicate, your materials are ready to go. Next, fill the blanks in your new templates with what you already know.

Now you are ready to enter the closed-loop part of the process. First, identify the gaps. The gaps are the missing or stale data in your templates. Assign the responsible stakeholders to collect the data needed to fill those gaps.

When the data comes in, analyze it, and assess the implications for your product. Then update your templates and distribute the fresh competitive intelligence.

Next is the regular inspection to ensure the process is running as expected. Try including a competitive intelligence review as a regular, standing agenda item in one or more of these forums:

- Product line reviews

- Strategy reviews

- Sales meetings

- Product management staff meetings

Provided that the forum occurs regularly, it will serve as a reminder to update your competitive intelligence.

How to Plug the Tough Holes

Even with a robust competitive intelligence system in place, you are still going to have some tough holes to fill. Those holes are often the specific details you need to fully build out your value proposition or ensure that your product positioning is effective. One way to close those gaps is to go to the market with your best assumptions about your competition and then let the market help you make corrections along the way.

Start with the set of sales presentations that articulate your advantages and value proposition. Make sure that these presentations are precise about how you differ from the competition. In places where you do not have sufficient data, resist the urge to go “vague.” Instead, use your best guess to describe your competitor’s capability in precise terms.

For example, if you were trying to distinguish your consumable parts cost versus your competitor’s, do not fall back to qualitative comparisons like:

“Lowest consumables cost.”

Instead, use your actual costs and your best guess for your competitor’s cost like this:

“Less than $150K per year in consumables versus $225K per year for our competitor.”

Next, gather up those sales materials and get on the road. Present them to your customers, suppliers, prospects, and other industry participants.

When you present “Less than $150K per year in consumables versus $225K per year for our competitor,” at some point on your road trip, someone is going to correct you and say, “The competitor’s consumables only cost $175K per year.”

Bingo! You have your data.

Obviously, you need to handle this process carefully. Your approach will vary depending on the norms and culture of your industry. Be thorough enough to achieve your objective, but do not compromise important industry relationships or anyone’s integrity.

Why Sales Fails to Get You Competitor Data

“No matter how many times we ask, the sales team never produces the competitive information that we need. Yet, they are not shy about criticizing us for wimpy marketing materials that don’t address the competitive issues. Why can’t they just help us out?”

If you are a product manager experiencing this frustration, you are not alone. However, you need to consider that you might be the problem. If you are open to this possibility, keep reading for your three-step improvement program.

1. Know Specifically What You Need

You must know the specific gaps in your competitive intelligence that keep you from effectively positioning your products. For example, if you are positioning your product on “fastest setup time,” you need to know your competitors’ setup times. If you do not know, there is your gap.

2. Be Specific with Your Requests

Sending an email to the entire sales team, asking them to send you anything they have about the competition is one of the biggest mistakes you can make. Two bad things happen. First, everyone on the “To” list will assume that someone else on the list will respond. This usually results in no response. Second, “send anything you have about the competition” is so ambiguous that the sales team will not know where to start. So, they do not.

Instead of shot gunning your request, take a more specific approach. Ask individual salespeople to help you find specific morsels of competitive intelligence. This will convey a sense of accountability to the salesperson and give him or her task clarity. It is fine to ask more than one salesperson for the same information since your competitors’ position and performance may differ for each customer.

3. Reward Their Effort

Sales teams often complain, “We send in all kinds of competitive information. But it is like feeding a black hole. Nothing ever comes back.”

You cannot expect the sales force to supply a steady stream of competitive information unless they see a return on their efforts. A salesperson does not differ from the rest of humanity in this regard. As the product manager, you need to turn the data from the sales force into updated competitive analysis, sharper product positioning, and better selling tools. Get these new materials into the salespeople’s hands and acknowledge the individuals who provided you with the data that made the new materials possible.