Table of Contents

- Introduction

- Abandon Feature-Benefit Product Overviews

- The Why-Buy Presentation Recipe

- Why-Buy Presentation Example

- The Problem-Solution Connection

- Substantiate Competitive Advantage

- Translate Advantage to Financial Value

- Apply Carnegie’s Tripartite Template

Introduction

“Why should I buy your product?”

Ask your sales team, and they will tell you they cannot be successful without a concise answer. You need a why-buy presentation.

The why-buy presentation is your top-level case for why a customer should buy your product at your price.

The why-buy presentation is the most important part of your capital equipment sales kit. Unfortunately, many companies live with a collection of features-and-benefits slides that never answer the most important question, “Why should I buy your product?”

Abandon Feature-Benefit Product Overviews

A product manager’s instinct is often to organize product overview presentations as a summary of key features and benefits. It feels natural to organize them this way. Plus, this approach does an excellent job of educating your customer about the key capabilities of your product.

The problem is that this leads to a presentation organized much like a tour through an art museum. You walk your customer through the system architecture, pointing out key features along the way, just as an art museum tour guide educates visitors about the paintings on the wall.

The result is also similar.

After a museum tour, you know a lot more about the paintings but feel no compulsion to buy the museum. A product presentation organized in the features-and-benefits tour format educates your customers but does not motivate them to buy. The solution is to abandon the features-and-benefits-style product overview. Instead, create a why-buy presentation organized around the customer’s problem and your unique ability to solve it. See Table 24.

| Typical Product Overview | Why-Buy Presentation | |

| Result | Educates | Motivates |

| Structure | Feature/Benefit | Problem/Solution |

The Why-Buy Presentation Recipe

The why-buy presentation makes a business case for buying your equipment. It contains two parts, a list of ingredients and an assembly method. The why-buy presentation’s key ingredients are your:

- Understanding of the customer problem and what suppliers like you should do about it

- Value proposition

- Positioning statement

- Position proofs supported with sources of competitive advantage and data

- Value model

You assemble these ingredients in the following order to make a convincing business case:

- Create a problem-solution connection.

- Substantiate your competitive advantage.

- Translate that competitive advantage into financial value.

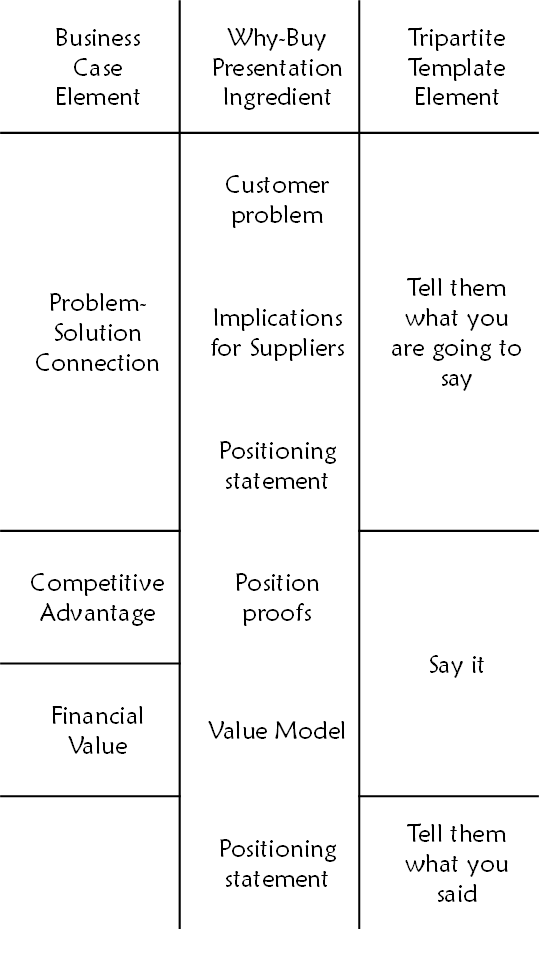

You make the why-buy presentation easy to follow and remember by following Dale Carnegie’s tripartite template for structuring your presentations. Namely to:

- Tell the audience what you are going to say.

- Say it.

- Tell them what you said.

Figure 59 shows how the why-buy presentation flow follows this recipe for a compelling, memorable business case.

Why-Buy Presentation Example

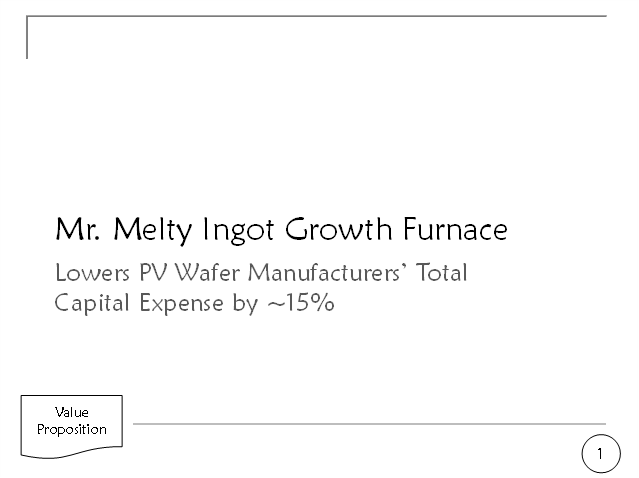

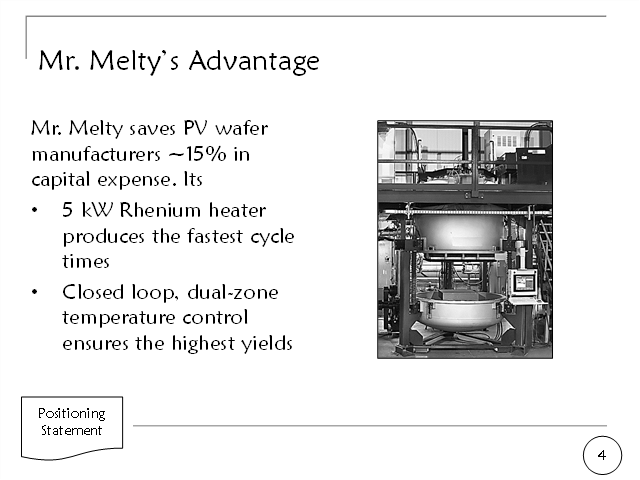

The example in Figure 60 applies the why-buy presentation recipe to the Mr. Melty ingot growth furnace for photovoltaic wafer manufacturers.

Note that the lower left-hand corner of each example slide is annotated with the why-buy presentation ingredient that the slide addresses. Your why-buy presentation would not include these annotations.

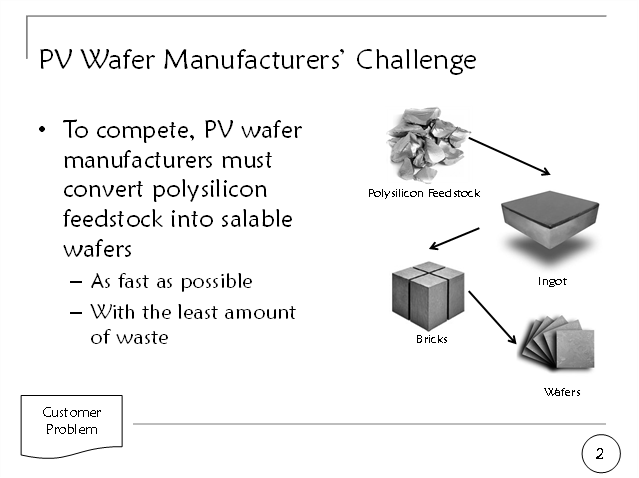

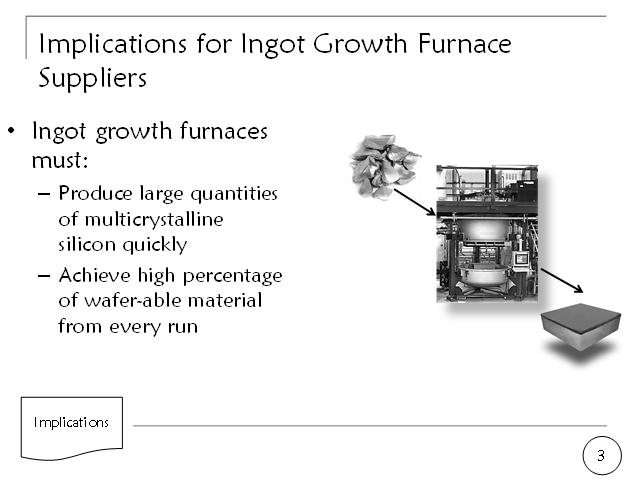

The Problem-Solution Connection

In the Mr. Melty example, slide numbers two, three, and four create a direct connection from the customer’s problem to your solution. This three-step process entails first stating the customer problem, then its implications for products like yours, and finally, how you uniquely address those implications. Notice that these three slides have line-by-line alignment. There is no mistaking in the Mr. Melty example that the 5kW rhenium heater produces the fastest cycle times to address the industry problem of converting polysilicon feedstock into salable wafers as fast as possible.

When constructing your why-buy presentation, strive to achieve the same obvious problem–implication-solution connection. If you find this difficult, try creating a worksheet like the one in Table 25 to make sure you have a clear problem-implication-solution link for each position.

Table 25: Problem-implication-solution worksheet

| Customer Problem | Supplier Implication | My Unique Solution |

| Turn polysilicon feedstock into salable wafers as fast as possible | Produce large quantities of multicrystalline silicon quickly | 5kW rhenium heater produces the fastest process times |

| Turn polysilicon feedstock into salable wafers with the least amount of waste | Achieve a high percentage of wafer-able materials from every run | Closed-loop temperature control ensures the highest yields |

| You know my problem. | You know what to do. | And you did it. |

When you make this well-constructed, problem-solution connection, your customer hears, “You understand my problem. You know what to do about it. And you did it.”

This clear problem-solution connection sets up the importance of your solution to the customer, provides the context for your unique value, and motivates him to hear more.

Substantiate Competitive Advantage

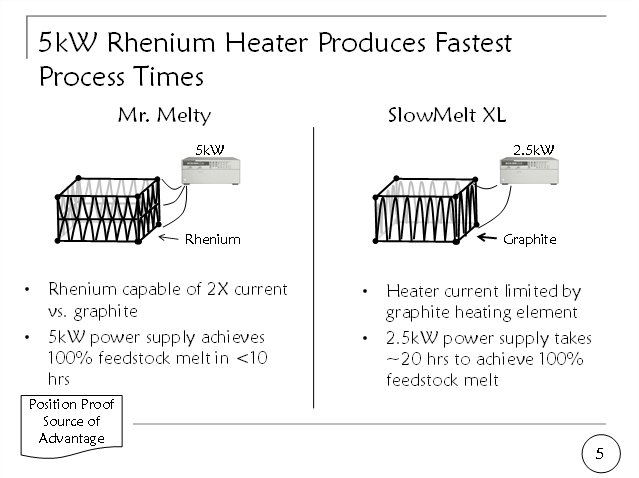

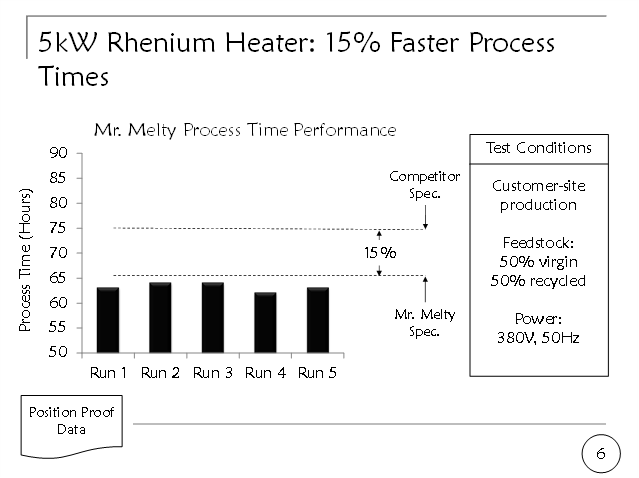

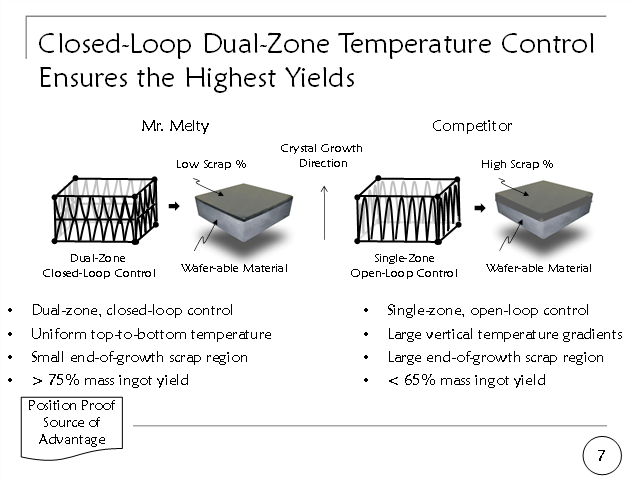

In this section, it may be tempting to fall back into a features-and-benefits tour approach. Do not do it. You must show that each position in the positioning statement on your advantage slide is unique and true. You can do this with a pair of position-proof slides for each position. The first slide of the pair shows the source of the advantage, and the second provides the data to prove it.

The source-of-advantage slide establishes your solution as unique by comparing your approach with that of your competitor’s. It is not enough to describe your solution. You need to draw direct, side-by-side comparisons of your superior solution with that of the competitor. Do not assume that the customer will figure out the important differences on his own. Remember, your aim is not to educate the customer; it is to convince him to choose your solution over alternatives. In the why-buy presentation example, Mr. Melty takes two positions: “fastest cycle times” and “highest yields.” Slides five and seven are the source-of-advantage slides for these two positions.

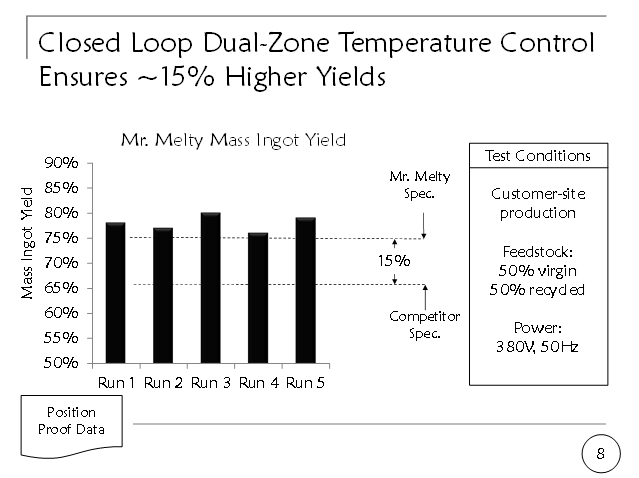

The proof-data slide contains representative performance data supporting your claim. Show data that compares your performance to that of your competitor. The best data comes from real customers showing head-to-head competition in the customer’s environment. A reasonable substitute is customer data for your product with the competitor’s specification overlaid. In the Mr. Melty why-buy presentation example, slides six and eight are the proof-data slides for each of the two positions.

Work hard to create the clearest evidence that your advantages are unique and demonstrable. On each slide, stick to the comparisons and data that address the positions that you have taken. Do not add irrelevant facts, data, or figures. They will only distract your audience.

Translate Advantage to Financial Value

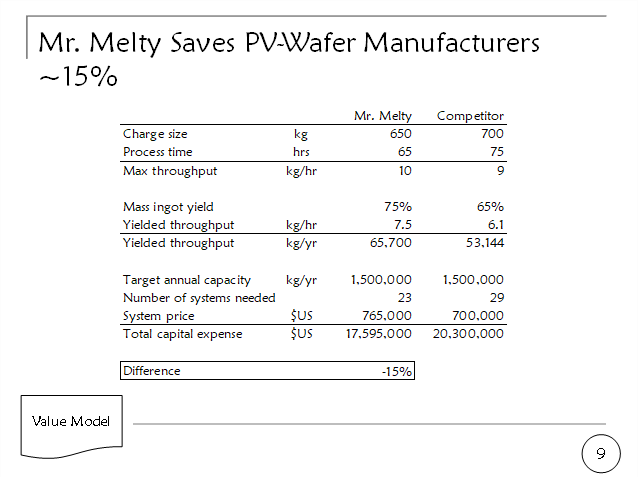

Remember, the only reason an organization buys capital equipment is to make a profit. Therefore, customer value is a financial expression. You need to relate your competitive advantage and price to increased profit for your customer. Your value model goes here. (For more on value modeling, see Part II: Value-based Strategy)

In the example why-buy presentation, Mr. Melty’s positioning statement articulates that Mr. Melty’s value proposition is a 15% capital expense savings produced by its fastest cycle time and highest yield. The value model on slide nine shows the math.

As a practical matter, you can expect that the value model slide in your why-buy presentation will be the slide most frequently tailored to address specific sales situations. That makes a sales-force-friendly value modeling tool a must-have for your sales kit.

Apply Carnegie’s Tripartite Template

Following Dale Carnegie’s presentation advice to “Tell them what you’re going to say; say it; then tell them what you said” will grab your audience’s attention and improve their key-take-away recall. Let us examine how the why-buy presentation applies this tripartite template.

Tell Them What You are Going to Say

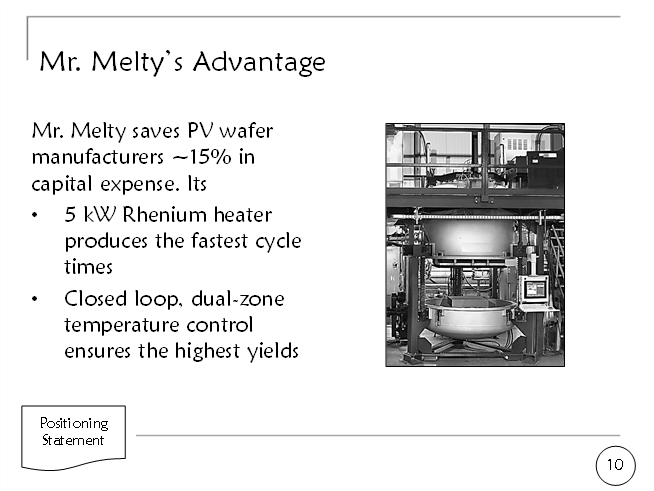

This is your opener where you establish the importance of your unique solution. Your positioning statement tells your audience what you are going to say. It serves as both the outline and the key takeaways of your why-buy presentation. See slides two through four in the Mr. Melty example.

Say It

Here is where you substantiate each element of your positioning statement. The two-slide position proofs substantiate the positions that you have taken. The value model substantiates your value proposition. See slides five through nine in the Mr. Melty example.

Tell Them What You Said

After substantiating your positioning statement, nothing will wrap up your presentation better than showing your positioning statement again. Your value proposition and the positions that make it true are the key takeaways of a why-buy presentation. See slide ten in the Mr. Melty example.