Have you ever noticed that some capital equipment companies seem to be able to develop and deploy new products faster than others? Have you noticed that those same companies also tend to produce a steady stream of very profitable upgrades for their installed base? Look under the hood, and you are likely to find that an effective platform strategy is the engine driving this performance.

A product platform is a collection of common elements that can be deployed across multiple products.

When you have a common platform, only a fraction of the system requires unique development to create individual products derived from that platform. As a result, you can deploy a portfolio of new products based on shared platforms much faster than you can with a portfolio of discrete, nothing-in-common products.

Platform commonality also produces operating leverage. In addition to product-development leverage, an effective platform strategy has parts commonality across a platform’s products. As a result, your operation manages fewer parts, buys higher volume, and develops fewer manufacturing procedures. The leverage doesn’t stop there. Your spare-parts inventory is more efficient, and your field service engineers can cross-train on multiple products in a snap.

An effective platform strategy also makes it hard for competitors to steal your customers. Two factors are at work here. First, customers that buy multiple product types from your common platform experience maintenance and operating efficiencies. These efficiencies increase the switching costs that a competitor must overcome. Second, when a platform survives multiple generations of a product line, it paves the way for a robust installed-base upgrade offering.

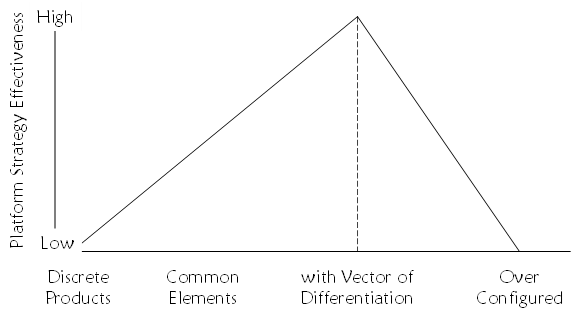

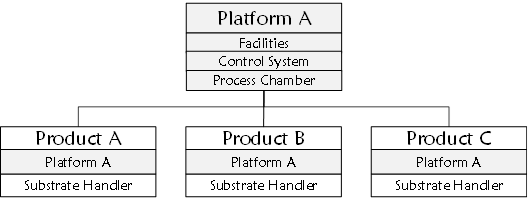

Platform strategy effectiveness depends on the degree of commonality and subsystems chosen to be shared. See the figure below.

At one end of the spectrum, you’ll find the absence of a platform strategy where all products in the portfolio are discrete with no commonality. At the other end, you’ll find over-configured common platforms. The sweet spot for platform strategy effectiveness lies between these two extremes. It’s where the platform contains common elements, for which all the derived products have common requirements, and among those common elements is your vector of differentiation.

Discrete Products

Let’s walk through these platform-strategy-effectiveness levels by way of an example. Imagine that you are the general manager of the thin-film deposition equipment business unit. Your business targets three semiconductor-related market segments. The table below summarizes the critical product requirements for each segment.

| Market Segment | Substrate | Film Quality |

|---|---|---|

| A | 6″ Sapphire Wafer | Very High |

| B | 4″ Silicon Carbide Wafer | Low |

| C | 12″ Silicon Wafer | High |

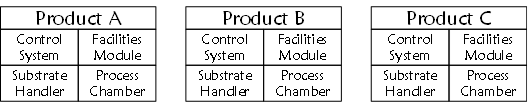

The engineering team proposes to address the requirements with three discrete product offerings. This first-pass architecture proposal from engineering contains no attempt to create common platforms across the product line. Therefore, don’t expect cross-product operating or innovation leverage. See the figure below.

Common Elements

However, you couldn’t help but notice that each product is made up of four subsystems as follows:

- Substrate handler

- Facilities module

- Control system

- Process chamber

You ask the engineering team to take another look at their architecture strategy. This time you ask them to look for opportunities for the three products to share any subsystems.

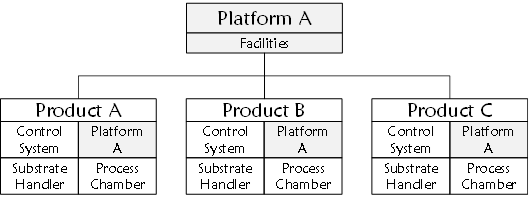

You’re in luck. Prompted by your request, engineering determines that all three products have the same power, water, and process gas requirements. Therefore, all three products can share a common facilities module. See their revised proposal in the figure below.

Now we are getting somewhere. By employing a common facilities module, your company can expect lower development costs, fewer parts to manage, and lower production and service inventory levels.

Common Elements with Vector of Differentiation

You’re feeling good about the direction this is headed. Then the lead engineer, turning towards the product-line manager, says, “Didn’t you say that our competitive advantage comes from our unique deposition-end-point-detection technology?”

“Yes, that is the vector of differentiation for all three market segments.” replies the product-line manager.

Lead engineer again, “The end-point-detection technology is part of the control system. Plus, the control system requirements are virtually the same across all three products. How about we make the control system a common element as well?” On the whiteboard, he draws the figure below.

As he’s drawing, you share your ah-ha moment.

“If we derive three products from our platform, but our vector of differentiation lives in the products, not the platform, we would need three engineering efforts to maintain our competitive advantage. However, with our vector of differentiation within the platform, we only need one engineering effort. Since we will be leveraging our engineering effort over the revenue from three products, we can invest at three times the rate of our competitors.

With this platform strategy, we’ll be tough to beat.”

Overconfigured Platform

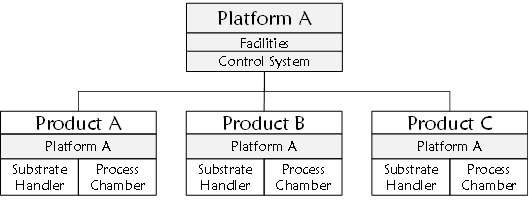

“Wait, I have another idea!” exclaims the lead engineer. “It’s also possible to make the process chamber common. We just have to design it to the most demanding requirements across the three products.”

Referring to the requirements for each market segment, the team concludes that the shared process chamber must process twelve-inch substrates at very high film quality. See the figure below.

You are thrilled. “Even lower development costs, even fewer part numbers, even lower inventory, even lower overhead. Profit will skyrocket!”

But your product-line manager brings you back down to earth. “We won’t have a single customer that values or will pay for all the capabilities in a common process chamber. Nobody needs twelve-inch wafer capability with very-high film quality. Despite that, we’ll carry the cost of this super-chamber with every system shipped.

Furthermore, how do you think our silicon-carbide customers are going to react when we tell them to plunk their four-inch wafers in our chamber designed for wafers three times that size?” I worry about facing competitors that have created more targeted solutions.”

The lead engineer’s final platform strategy proposal amounted to an over-configured platform. It burdened the derivative products with capabilities that

- Add cost but no customer value, or

- Compromise market-specific, value-driver performance.

Like all business strategies, platform strategy must start with an external perspective. To avoid over-configured platforms, only create common platforms for common requirements.