You must select market segments that will serve as your product strategy’s target(s). When choosing the most attractive segments, you must consider opportunity and fit. Opportunity refers to the potential buy-rate of the segment. Fit refers to how well serving the segment fits with your organization’s capabilities.

Opportunity factors include:

- Segment size,

- Segment growth rate, and

- Potential for unique value and competitive advantage.

Fit factors include

- Alignment with your product’s capabilities,

- Alignment with your product’s sales and service channels, and

- The cost, time, and risk associated with developing unique value and competitive advantage.

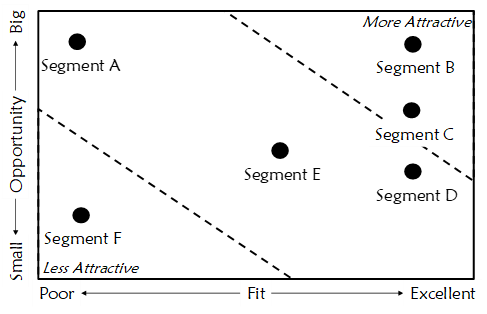

Score both opportunity and fit factors for segments that are potential product strategy targets. Then plot the results on an opportunity-versus-fit chart like the one in the figure below.

The more northeast a segment appears on the opportunity versus fit plot, the more attractive the segment. For example, in the figure above, segment B is the most attractive. You would likely select it as the primary market for your product strategy.

The next question you need to answer is, “Beyond my primary market, what other segments should my product line also serve?” For the answer, focus on the fit axis. If you can access other valuable segments with little additional effort, you might decide to add them to your primary market.

Let’s examine the other segments in the figure above. Segment F is neither a good opportunity nor a good fit. It should not be a target market segment. Same with Segment A. It’s a significant opportunity. But its poor fit means it is probably an opportunity for a different product line.

Segments C and D look attractive. They might be good candidates to include in your market strategy if a simple product derivative, an easy-to-implement extension of your sales channel, or some combination of the two can serve these segments.

You might also be tempted to include Segment E. It’s a significant opportunity that falls in a gray zone between a poor and a good fit. Before yielding to your temptations, you should consider the cost to meet the requirements of a gray-zone-fit segment. The cost potentially includes

- Design and test costs,

- On-going field inventory carrying costs,

- Depreciation cost of engineering equipment and support tooling,

- Additional test development, documentation, and training,

- On-going support for different product configurations,

- “End of life” management for the unique parts,

- Additional marketing costs, and

- Opportunity costs of not focusing on your primary market.

When you stray from close-fitting market segments, you create new product development, marketing, and support obligations. You dilute the focus on your primary market. The more disparate segments you chase, the less likely you will achieve a leadership position in your primary market.

Let’s illustrate with an example. Say your primary market has an annual buy rate of one hundred machines. Suppose that they have an emerging requirement for temperature-controlled processing. Your primary market will require this new capability over the next two years, but customers will begin evaluating suppliers in the next six months. You and your competitor have typically split this market right down the middle. The supplier that is first to market with a temperature-controlled processing solution stands to disrupt this historical 50-50 market share split.

You have also identified an opportunity to enter an adjacent market segment. To serve this segment, you need to develop a new option for your machine. You estimate that this adjacent market segment’s annual buy-rate will be six machines.

The product development effort for the temperature-controlled processing capability for your primary market is about the same as that for the option for the adjacent market.

Developing the option for the adjacent segment will at most produce six system sales a year. Beating your competition in the race to meet the new temperature-controlled process requirement in your primary market has the potential to produce a hundred system sales. Focusing on your primary market returns a much higher reward for your efforts.

“Wait a minute,” you say. “Why not do both?” You could. But who is likely to win the race to satisfy your primary market’s new temperature-controlled processing requirement? The company with laser-beam focus, or the one chasing every opportunity? What if you lose?