Table of Contents

- Introduction

- Technical Advantages vs. Value

- Not All Value Drivers are Buying Decision Drivers

- Buying Decision Driver Example

Introduction

As articulated in chapter 6, the customer defines value. Your customers are capital equipment buyers. Since you can define the customer at a high level, you can also define value at a high level.

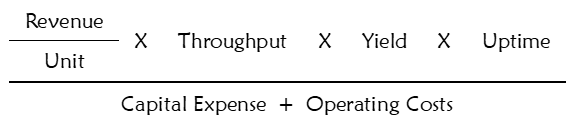

For capital equipment buyers, financial value is a function of the equipment’s output and the cost to produce that output. The top-level value drivers for all capital equipment are the same. It does not matter if it is a piece of manufacturing equipment, a bulldozer, or a jet airplane.

Value drivers are the factors that affect the financial outcome of owning a piece of capital equipment.

See Table 8 for the six universal capital equipment value drivers.

| Value Driver | Description |

| Revenue/unit | Revenue that the buyer extracts from each unit of the product or service that the equipment produces |

| Throughput | The rate at which the equipment processes the unit |

| Yield | The percentage of good units that the equipment produces out of the total processed |

| Uptime | Percentage of time that the equipment is available for use and not in a repair or maintenance state |

| Operating costs | All costs associated with running the equipment, such as utilities, maintenance, and repair |

| Capital expense | Equipment purchase price (or period depreciation expense) |

From these value drivers, you can create a comprehensive value expression for capital equipment. See Figure 19.

This comprehensive value expression describes the revenue that your customer can earn with your equipment, divided by the cost of producing that revenue. It captures all the gains and costs associated with capital equipment ownership expressed as output over cost. You may recognize this as the reciprocal of equipment cost of ownership (COO), which the capital equipment industry usually expresses as cost over output.

Technical Advantages vs. Value

Suppose you are one of the lucky ones. Your target market overwhelmingly chooses you over the competition because of your technical advantage. Or suppose you are not so lucky. Your target market overwhelmingly chooses the competition, despite your clear technical advantage.

If your superior technology consistently puts you in the winner’s circle, it is easy to convince yourself that “Our customers don’t buy on value; they buy based on technology.” If you keep losing despite your superior technology, it is equally easy to rationalize, “Our customers just don’t recognize the value of our technology.”

Make no mistake. In both situations, your customers make buying decisions based on economic value. They are buying the solution that will make them the most money. If you want to know what’s driving buying behavior and how to establish value-based pricing, you must understand how your superior technology translates into financial value for your customer.

Superior Process Specifications

Your superior technology can lead to legitimate marketing claims that you can do something the competition cannot. That claim usually comes in the form of a process specification. Examples of process specifications include:

- The distance that a commercial airliner can fly.

- The weight that a crane can lift.

- Film uniformity for thin-film deposition equipment.

- Resolution of a microscope.

- Accuracy of pick-and-place manufacturing equipment.

- Cleanliness of the workpiece process environment.

Process specifications define the workpiece that your capital equipment can process.

Your customers need to know your process specifications to figure out if your equipment can operate on their workpiece. For example, suppose you are a commercial jet manufacturer selling to airlines that feature long-haul, non-stop flights. Your customers would need to know your maximum non-stop flying distance to figure out if you can fly their passengers. Here, long-haul passengers are the workpiece.

Source of Value

Process specifications are not value drivers, but they can be a source of value. They can be a value-driver driver.

Say your customers routinely cite your superior process specification as why they buy from you. Here, the process specification is affecting one of the capital equipment value drivers driving the buying decision. Your job is to understand which one and how.

For example, suppose you are the only manufacturer selling commercial jets with a 10,000-mile-non-stop-flying process specification. Airlines with long-haul routes that buy this jet from you can offer direct flights to almost any destination. Also, tickets for direct flights sell for higher prices than flights with connections. Therefore, your 10,000-mile-non-stop-flying specification improves the revenue-per-unit factor in the comprehensive value expression. Your value modeling would need to compare the economics of your direct-flight solution with your competitor’s connecting-flight solution.

Irrelevant

Better process specifications, however, do not automatically translate into higher value.

Consider the same 10,000-mile-non-stop jet. But this time, your customer is a regional airline that only flies 1,500-mile and shorter routes. Several jet suppliers exist that can fly 1,500 miles non-stop. For this customer, your superior 10,000-mile-non-stop-flying specification is irrelevant and does not create any added value.

So, whenever you are struggling to understand the impact a superior process specification has on customer value, ask and answer, “How does that process specification affect one or more of the value drivers in the comprehensive value expression for this customer?”

Not All Value Drivers are Buying Decision Drivers

The comprehensive value expression captures all the value drivers related to owning a piece of capital equipment. It is useful for budgeting costs and forecasting output. However, you are looking for the subset of value drivers that matter to capital equipment buying decisions.

Buying decision drivers are the subset of all value drivers that determine the purchasing decision.

Value drivers that are insignificant or common among buying options do not enter your prospect’s purchasing decision. For example, if utility costs are insignificant for an equipment type, they will not be a factor in the purchasing decision. Similarly, if your equipment’s uptime is the same as your competitor’s equipment, it will not matter to the buying decision. To find the subset of value drivers that are the buying decision drivers:

- Start with all the value drivers in the capital equipment comprehensive value expression.

- Select the value drivers that are significant to the customers’ economics.

- Determine where meaningful differences exist or will exist among alternative solutions.

- Keep only the value drivers that are both significant and different.

- Always keep the price.

Buying Decision Driver Example

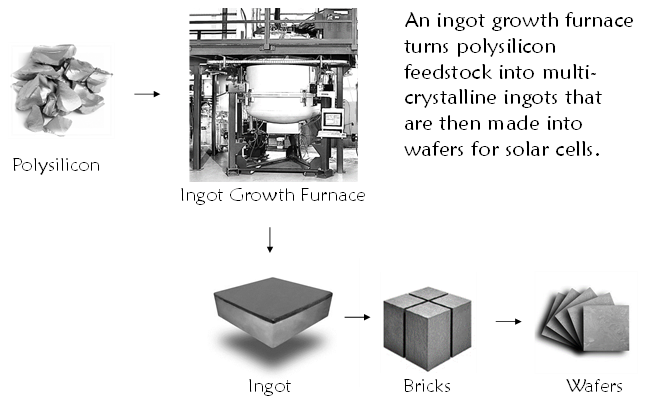

Mr. Melty is a multicrystalline silicon ingot growth furnace sold to silicon wafer manufacturers who sell these wafers to photovoltaic (PV) solar cell makers. An ingot growth furnace turns polysilicon feedstock into PV-grade multicrystalline ingots. An ingot growth furnace melts polysilicon at over 2,000°C, then slowly cools it to precipitate contaminants and form a multicrystalline ingot. Wire saws slice these ingots into wafers used to manufacture PV solar cells. See Figure 20.

An ingot growth furnace sold to PV wafer manufacturers fits the definition of capital equipment. That means you can use the capital equipment comprehensive value expression’s value drivers (step 1). For ingot growth furnace value-driver descriptions, see Table 9.

| Value Driver | Description for Ingot Growth Furnace |

| Revenue/unit | Material quality affects ultimate solar cell efficiency, and the revenue PV manufacturers can derive from each kilogram of material produced |

| Throughput | The amount of material (charge size) per run divided by the time to process it |

| Yield | The percentage of good material in each ingot produced, called mass ingot yield |

| Uptime | Percentage of time the furnace is available for use and not in a repair or maintenance state |

| Operating costs | All costs associated with running the equipment, such as consumables, utilities, and maintenance |

| Capital expense | Furnace purchase price (or depreciation expense) |

Now suppose that after an extensive market engagement, you have determined:

- The price that the PV wafer manufacturer gets for each wafer has a significant impact on his profitability. Material quality from ingot growth furnaces determines wafer pricing.

- The total output of each ingot growth furnace is the most significant factor driving the PV wafer manufacturer’s economics. This means that the equipment must produce acceptable material, process it quickly, and be reliable.

- Melting polysilicon consumes an enormous amount of electricity. It is one of the largest costs associated with producing multicrystalline ingots.

With this you can determine which value drivers in the comprehensive value expression are significant to ingot growth furnaces’ economics (step 2). Now suppose your competitive analysis has revealed:

- All furnace suppliers produce the same quality material.

- Major throughput differences exist among furnace suppliers.

- Good material yield varies across suppliers.

- No meaningful electricity consumption differences exist.

- Equipment reliability across all suppliers is the same.

From the above, you can figure out where there are meaningful differences among ingot growth furnace suppliers (step 3). Then you can select the value drivers that are ingot growth furnace buying decision drivers (steps 4 and 5.) In this example, the buying decision drivers are throughput, yield, and equipment price. See Table 10.

| Step 1 | Step 2 | Step 3 | Steps 4 & 5 |

| Value Drivers | Critical to Economics? | Supplier Differences? | Buying Decision Driver? |

| Revenue/unit | X | ||

| Throughput | X | X | X |

| Yield | X | X | X |

| Uptime | X | ||

| Operating costs | X | ||

| Equipment price | X | X | X |